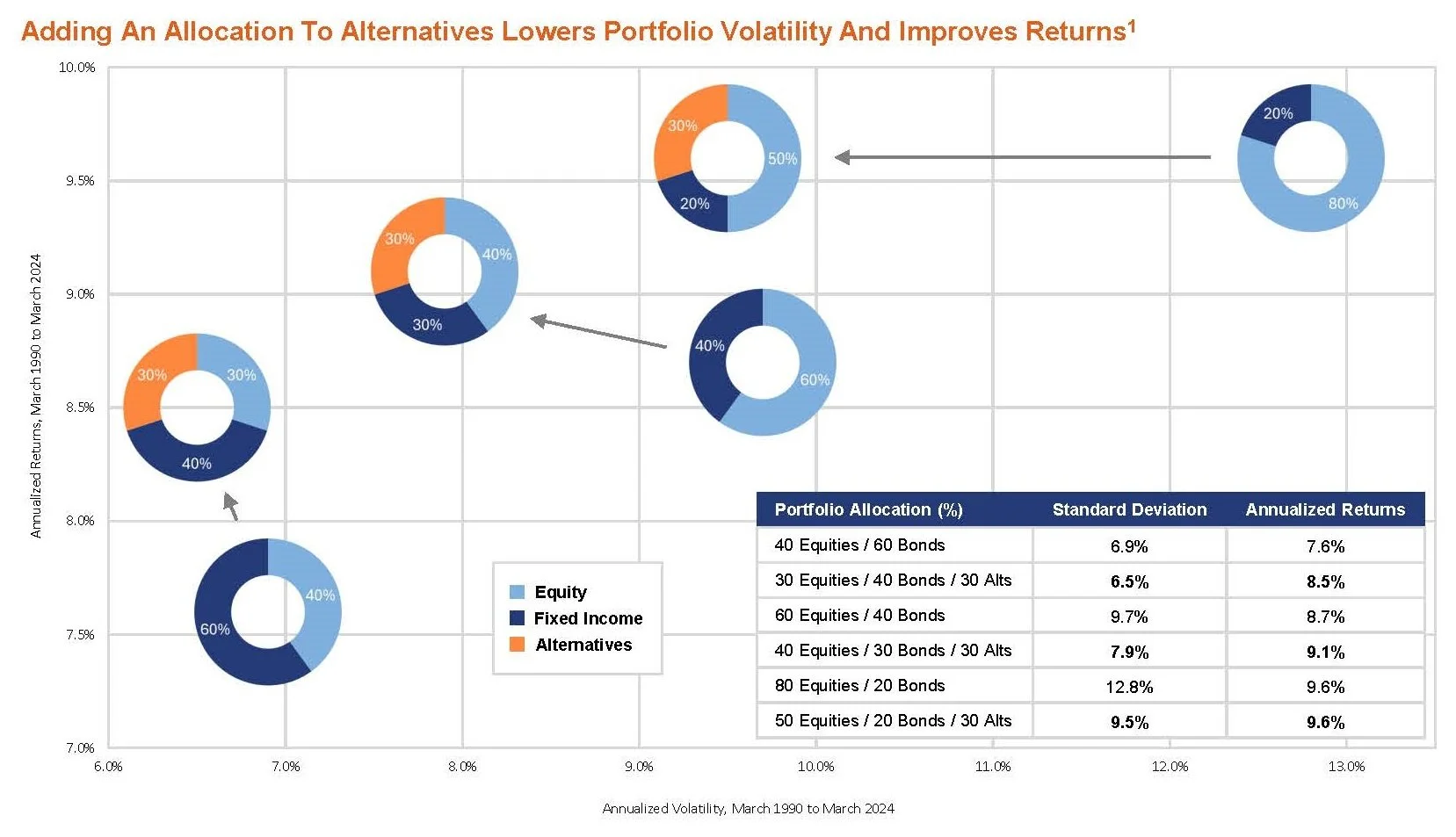

Why Adding Alternatives Can Mean Less Risk and More Return

This chart, provided by our friends at Centurion Asset Management, highlights 30 years of data showing that even with the same asset mix, adding a 30% allocation to alternatives can significantly reduce portfolio risk while enhancing long-term returns.

The takeaway: public equities alone tend to deliver lower risk-adjusted returns than alternatives.

Every time you invest solely in the public markets, you may be accepting more risk than necessary — and settling for less return over time.

Source: Centurion Asset Management