The recent period, where we have experienced rapid increases in interest rates, has caused many investors to pause when considering real estate as an investment asset class. Central banks try to manage rate changes carefully, as rate changes can have a direct negative impact on capital markets, affecting borrowing costs, which then reduces investments in equipment, labour etc. Ironically an increase in rates can even increase inflation by increasing the costs to purchase necessary items. Gross mismanagement of the Covid crisis, by governments all over the world, has left us with a situation where central banks have made extraordinary increases in rates, causing too many problems to mention, including volatility in the real estate market. Should investors wait on the sidelines to see where markets settle, or until we see more predictable trend lines? While it’s tempting, we are bullish on real estate and here’s why. Real estate has historically delivered high risk-adjusted returns, low volatility, security, and cash flow. This asset class typically makes up around 25% of the portfolios for major pension funds, and for ultra-high net worth (the smart money) investors. We are convinced that real estate should always be considered a long-term investment, and the current market environment should present entry-point opportunities. Real estate is a very broad term. Valuation metrics can vary by type of asset: single-family residential, multi-family residential, commercial, office, and industrial. These of course vary, by region and physical location, where local supply and demand factors have a significant effect. Currently, we favour multi-family residential assets in the right jurisdictions. Some of the primary growth locations have delivered, and are delivering, very strong growth which ensures strong demand and predictable revenues from rents and outright sales. Langford, BC, for instance, grew by 50% over a decade. Multi-family rentals have historically been very stable, and provide good security with strong cash flow. The biggest factor behind our multi-family bullishness is that we have more people than places for them to live. The following chart by National Bank Financial makes this shockingly clear:

https://mailchi.mp/dealpoint.ca/calgary-fintech-awards?e=4ef9dbab10

https://tiger21.com/news/private-equity-is-now-king-cnbc-com-article-with-tiger-21-founder/

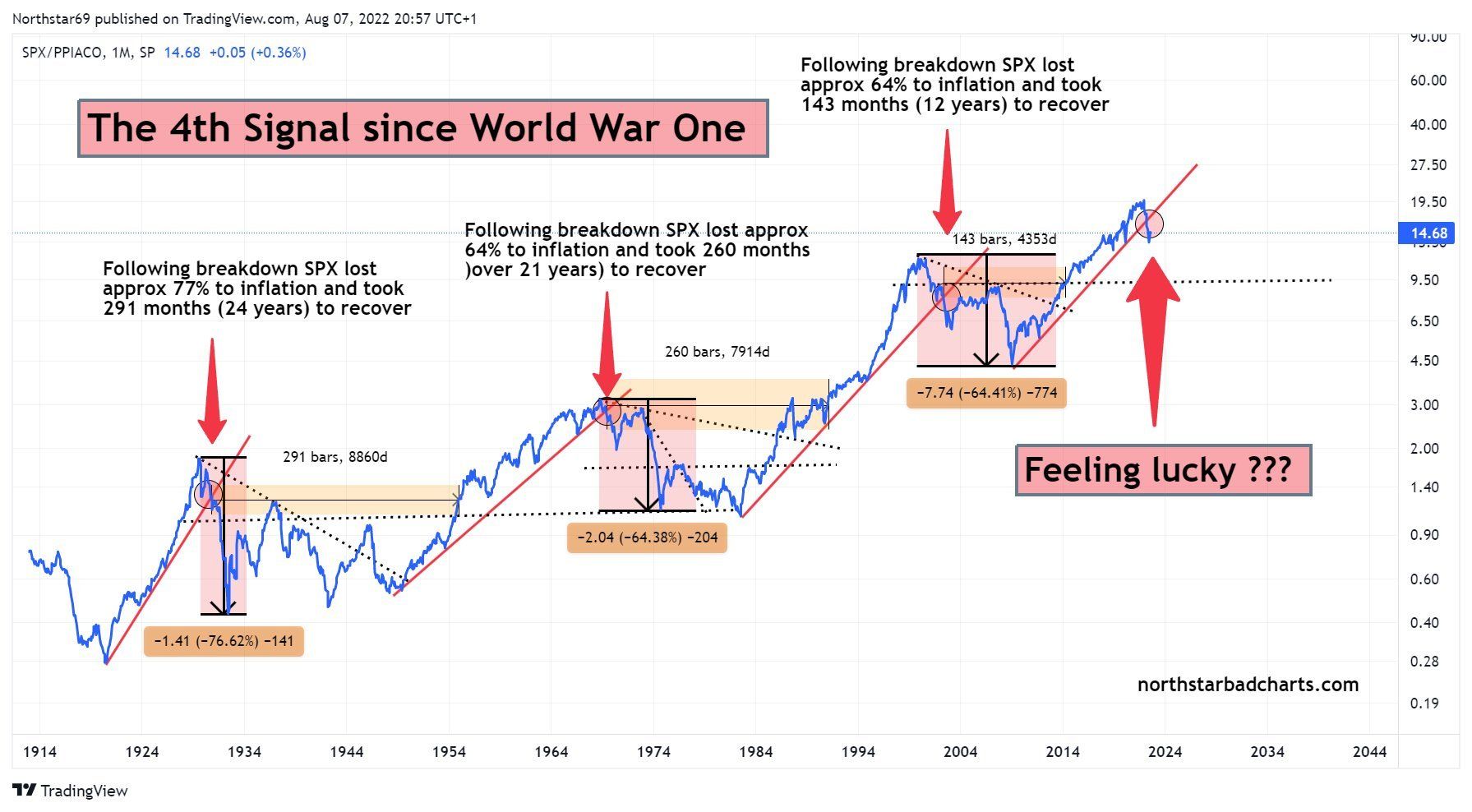

In 1929, the Standard & Poors Index (SPX) lost 77% to inflation. It took 24 years to recover. In 1987, the SPX lost 64% to inflation. It took 21 years to recover. In 2009, the SPX lost 64% to inflation. It took 12 years to recover. Bear markets generally last for five years. Can any of us really afford the risk of public market investing????